In this article:

- Delivering great digital experiences: It’s about meaningful engagements and trust

- The role of AI and two-way omnichannel conversations in banking digital transformation

- Pinpointing the biggest customer engagement opportunities in digital transformation for banking

- What’s next? Does digital transformation ever end?

In a world where consumers are moving away from in-person meetings and embracing digital interactions, how can banks deliver best-in-class customer experience?

The latest Sinch study, which surveyed over 2,900 consumers across the globe, reveals today’s consumers banking-related priorities and engagement preferences and pinpoints the features and solutions they want most from their banking relationships.

Read on to find out what you should focus your banking digital transformation efforts on and how to get ready for what’s next.

Delivering great digital experiences: It’s about meaningful engagements and trust

What’s the role of a bank as consumers adopt digital technology over in-person banking? How can banks maintain relationships when in-person interactions are disappearing?

Our study found customers want to try out new digital experiences and tools and are willing to build deeper connections with their banks if it leads to more personalized solutions and smarter decisions.

But deeper connections require trust — and it goes far beyond customer data protection and fraud prevention. The research shows that what drives trust in this new digital landscape is the quality of the experience customers receive. Customers want to feel their bank has their best interests at heart.

“It’s a human business at the end of the day, no matter how digital we make it,” says Mary McDuffie, Navy Federal Credit Union CEO.

Despite the widespread acceptance of messaging-based interactions, banks need to give customers the option to easily transition to a call with a human agent when the situation requires it — especially in moments of frustration.

The role of AI and two-way omnichannel conversations in banking digital transformation

Omnichannel communication and personalized customer experience represent an ongoing challenge for banks, which must break down data silos inside institutions, safeguard customer data, and offer hyper-personalized services on their customers’ preferred channels.

Rather than responding with messages designed to fit the needs of thousands, banks should target responses to the needs of just one: the customer in the chat stream.

Legacy systems are now giving way to more flexible technology that makes it easier to scale omnichannel, always-on engagement. Banks are investing massive amounts of money in cloud-based omnichannel customer engagement platforms, conversational AI, automation, machine learning, and security to create personalized, real-time experiences that evolve with customers’ changing behaviors.

The research clearly shows consumers’ eagerness for two-way conversations on digital channels: 53% say they’re frustrated when they can’t reply to a mobile message.

Our findings show a strong enthusiasm about the immediacy of artificial intelligence (AI) or chatbots. For many banks, automated conversations and chatbots are an important way to improve wait times and customer satisfaction while reducing costs and increasing conversions. That’s because many queries are easy to answer — an ideal application for chatbots.

Using AI and natural language processing to automate conversations has been a big challenge for organizations; but due to significant advances in the field, companies are now finding chatbots can resolve a much wider spectrum of customer queries.

Pinpointing the biggest customer engagement opportunities in digital transformation for banking

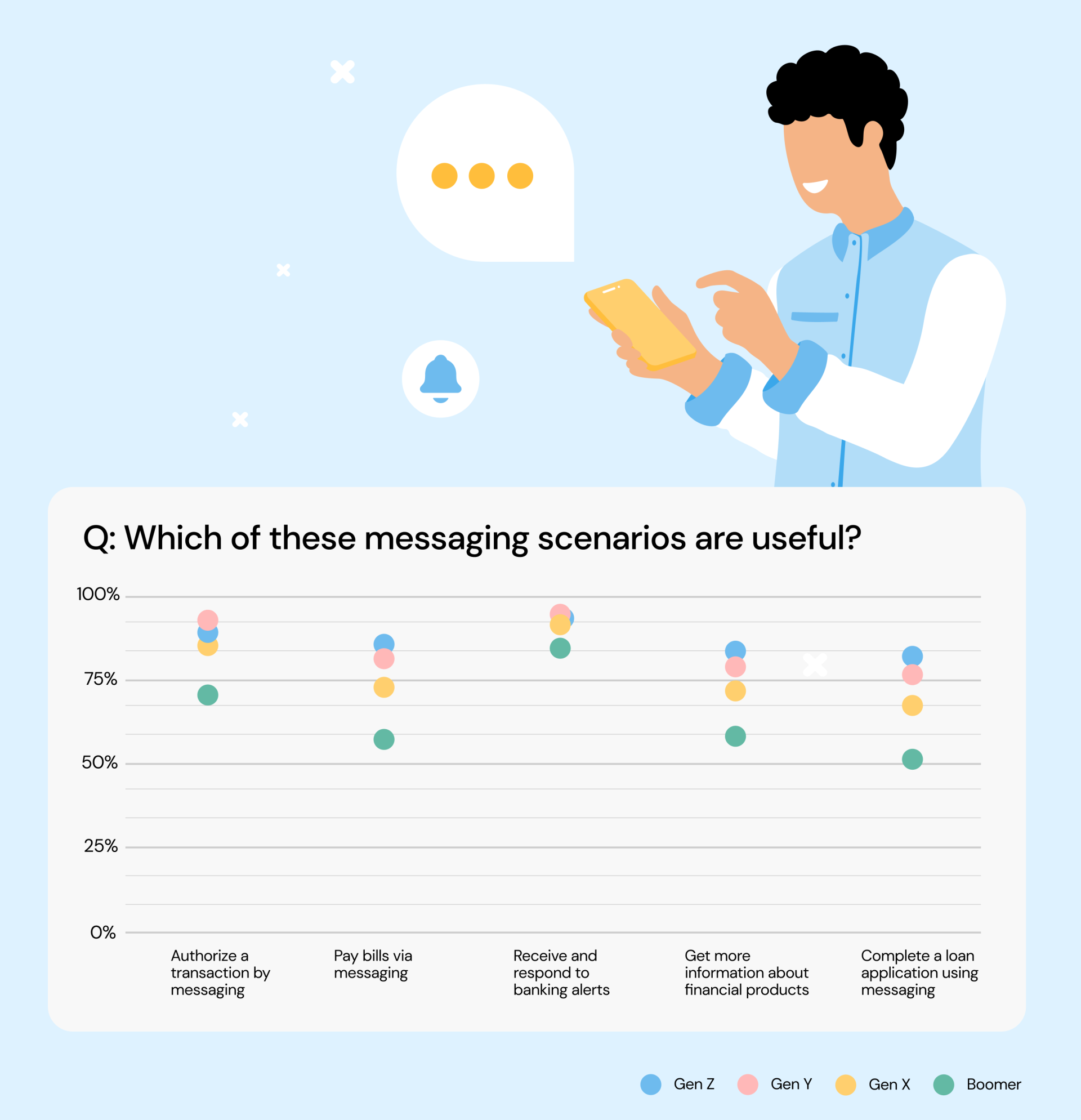

The survey examined what kind of solutions banking consumers value most, asking them to identify the messaging-based scenarios they find useful.

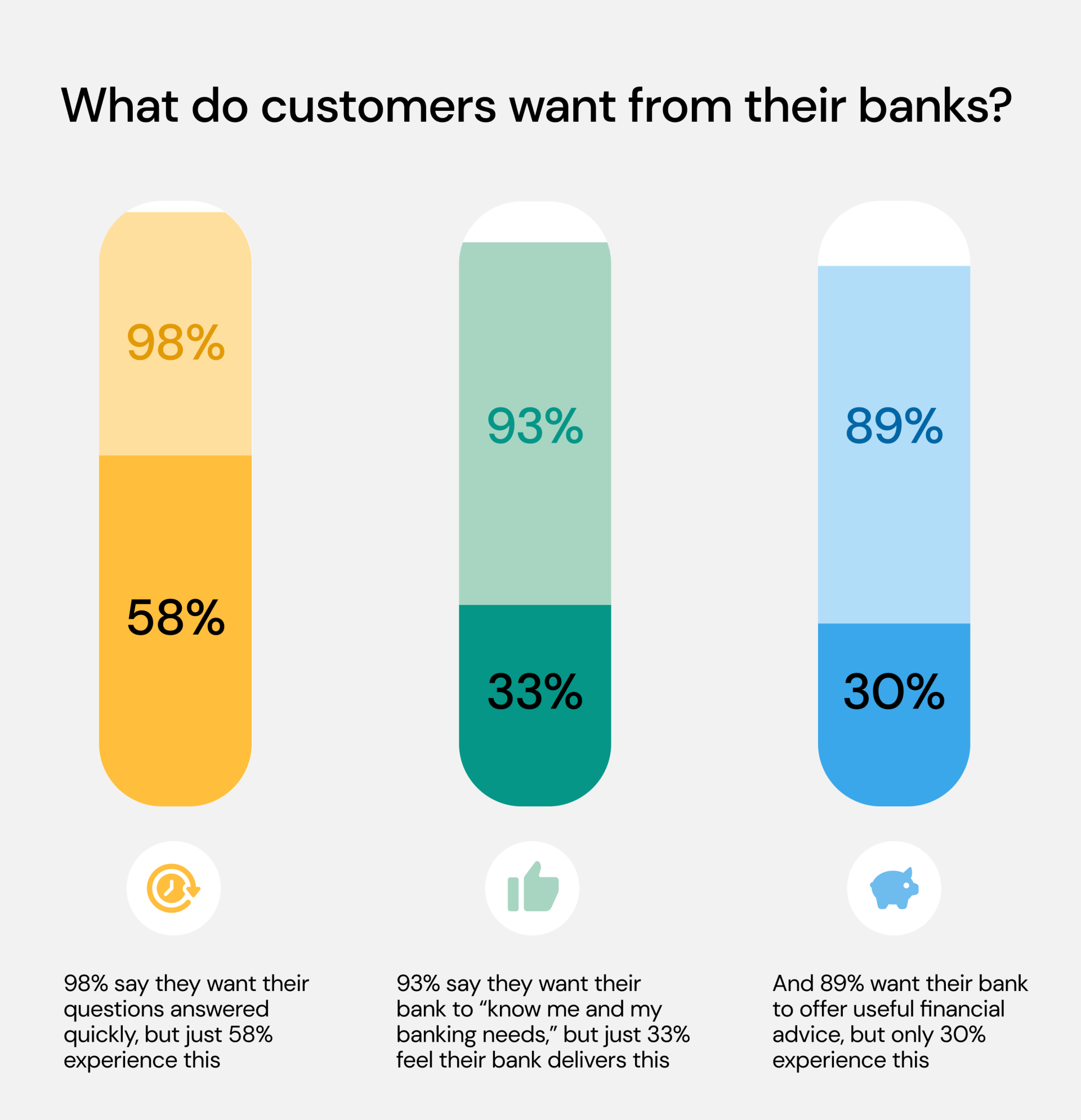

The research also highlighted the biggest opportunity gaps in digital banking experiences. As you can see on the image below, the main improvement areas identified are in human experiences, for instance:

- 93% of consumers globally say they want their bank to know them and their banking needs

- But just 33% feel their bank delivers this — a gap of 60 percentage points.

Other areas to focus on include:

- Providing quick answers to banking-related questions — 98% of consumers say they want their questions answered quickly, but just 58% experience this

- Offering useful financial advice

- Providing personalized, educational content in rich formats like videos to help consumers reach their financial goals

These features and utilities aren't futuristic, complex investments; they're solutions available on the market today for banks ready to deploy them.

What’s next? Does digital transformation ever end?

Digital transformation isn’t really a destination. Rather, it’s a journey that involves moving away from legacy systems to adopt new technology, tools, and channels that enable seamless omnichannel communication, better experiences, more efficient processes, and in turn, lasting customer relationships.

But successful digital transformation isn’t only about implementing new technology, even though, let’s face it, it’s a big part of it. It’s about what you do next.

- It’s about building a strategic approach that’ll allow you to adapt and respond to fast-changing customer needs, behaviors, and expectations. In an industry characterized by strong security standards and regulations, that’s no small task — which is why you should work with technology partners that make compliance and data protection a top priority.

- It’s about turning personalized conversations into actionable customer data to deliver best-in-class, holistic experiences.

- It’s about using technology to create a secure, dynamic ecosystem that truly revolves around the customer, all while maintaining human connections. Just like Triodos did!

“Integrating the listening processes, surveys, personalized interviews, ad hoc studies, website data and transactions, social media movement, chat messages or video messages we receive; all of this serves to evaluate what the clients need in real-time.” - Sergio Rodriguez, Customer Experience Specialist, Triodos Bank.

Want even more details on how to build a future-ready banking customer experience? Download Sinch’s latest industry report: Bank to the Future.

And when you're done, check out our complete guide to financial services communications to explore strategies and real-world examples of how you can enable meaningful and secure customer connections, without the hassle of juggling multiple partners or complex solutions.